Some insurance companies also use credit report information, along with other factors, to help predict your likelihood of filing an insurance claim and the amount of the claim. You’re more likely to pay higher interest rates on credit you do get.

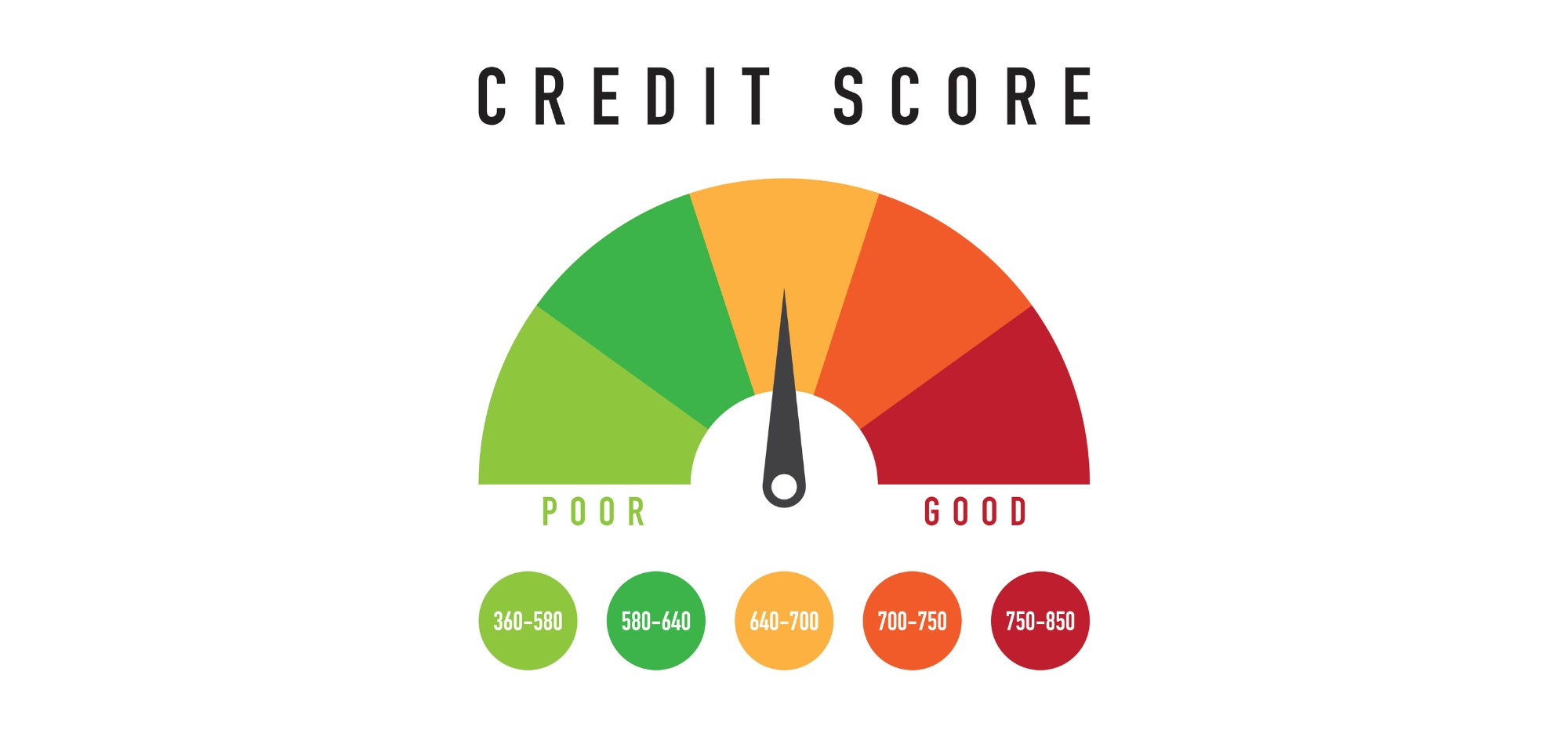

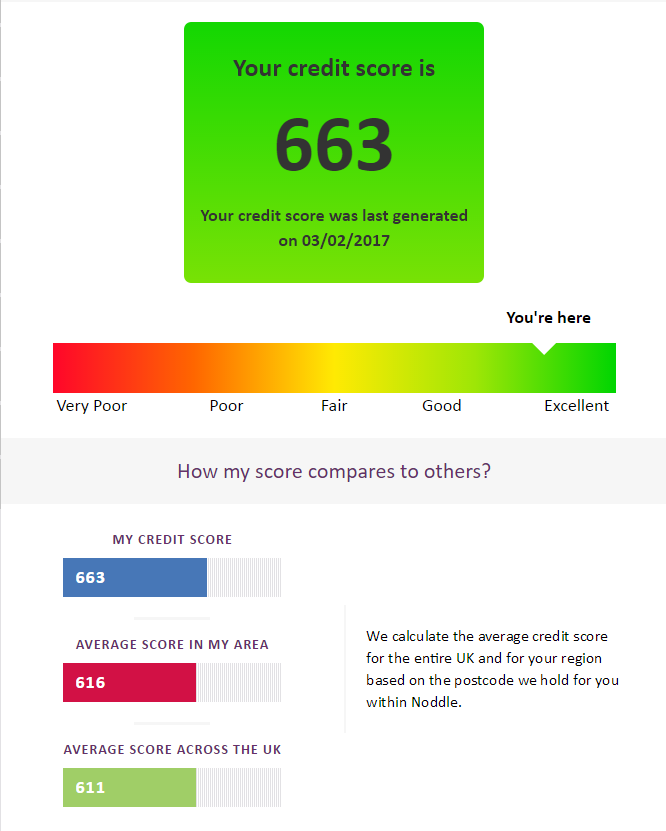

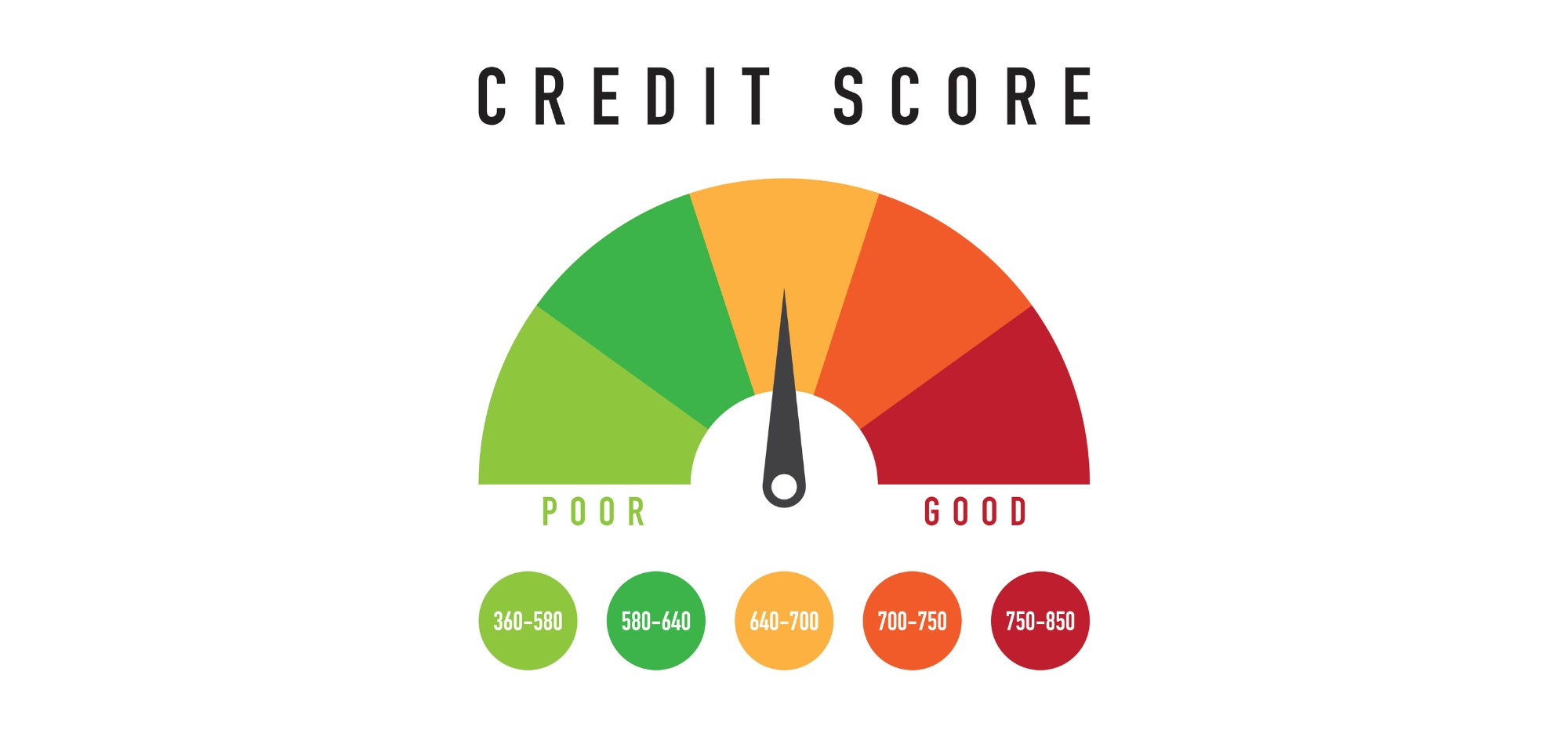

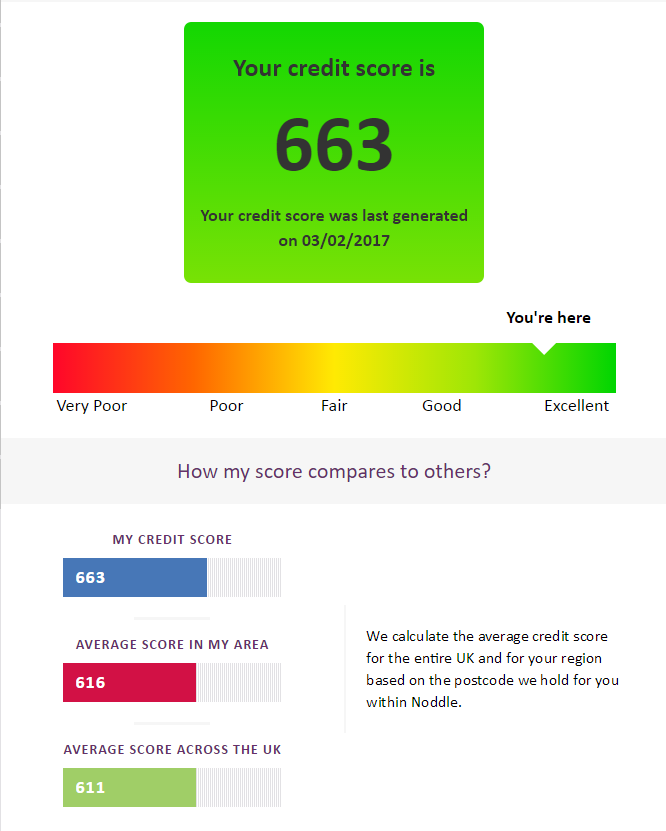

A low score means you have “bad” credit, which means it will be harder for you to get credit. You’re more likely to get credit: a loan, credit card, insurance - or to pay less for that credit. A high score means you have “good” credit, which means businesses think you’re less of a financial risk. Usually, your credit score will fall between 300 and 850. It might be interesting to know your score, but you can decide if you want to pay to get it. Your credit score is based on what’s in your credit history: if you know your credit history is good, your credit score will be good. Is it important to get my credit score?īefore you pay any money to get your credit score, ask yourself if you need to see it. CREDIT SCITE FOR FREE

If you see an offer for free credit scores, check closely to see if you’re being charged for credit monitoring. It’s not always clear that you’ll be charged for the credit monitoring. This kind of service checks your credit report for you. Other companies might give you a free credit score if you sign up for their paid credit monitoring service. A credit bureau might give you free credit scores. Unlike your free annual credit report, there’s no free annual credit score. How do I find out what my credit score is? That includes what interest rate you’ll pay to borrow money. Many different kinds of businesses use your credit score to help decide whether to give you credit and what the terms will be. Credit scoring systems calculate your credit score in different ways, but the scoring system most lenders use is the FICO score. Lenders calculate your credit score using i nformation in your credit report, like your history of repaying money you borrowed, the types of loans you’ve had, how long you have had a particular line of credit or loan, and how much total debt you owe.

What can I do to improve my credit score?Ī credit score is a number that represents a rating of how likely you are to repay a loan and make the payments on time. What if I’m denied credit or insurance, or don’t get the terms I want?. What’s the connection between my credit report and my credit score?. Is it important to get my credit score?. How do I find out what my credit score is?. Identity Theft and Online Security Show/hide Identity Theft and Online Security menu items. Unwanted Calls, Emails, and Texts Show/hide Unwanted Calls, Emails, and Texts menu items. Money-Making Opportunities and Investments. Jobs and Making Money Show/hide Jobs and Making Money menu items. Credit, Loans, and Debt Show/hide Credit, Loans, and Debt menu items.

Shopping and Donating Show/hide Shopping and Donating menu items.

0 kommentar(er)

0 kommentar(er)